- SAP FICO

How SAP FICO Services Can Benefit Your Business

Ever wonder how big companies manage everything? Many businesses rely on Enterprise Resource Planning (ERP) systems, offered by SAP FICO, short for Finance and Controlling, which is a crucial part of SAP that specifically handles a company’s financial health.

This blog will show you exactly how Advayan’s SAP FICO services can give your business a major advantage. Keep reading to find out how SAP FICO can improve your financial management, cut costs, and help you make smarter decisions!

Table Of Content

- What is SAP FICO?

- What are SAP FICO Consulting Services?

- Benefits of Using SAP FICO Services

- How Advayan Can Help With SAP FICO Services

- Conclusion

What is SAP FICO?

SAP FICO `Financial Accounting´ (FI) and `Controlling´ (CO) combination of two SAP modules within the SAP ERP system that handles various financial processes and functions. It serves as a central hub for managing core financial activities, including accounts payable, accounts receivable, general ledger, and fixed assets.

SAP FICO services can help you streamline and manage your finances in several key areas:

1. Money In and Out:

- Managing Bills (Accounts Payable): Keeps track of money owed to suppliers and helps you pay them on time.

- Collecting Payments (Accounts Receivable): Manages money owed by customers and makes sure you get paid efficiently.

2. The Big Picture (General Ledger): It records every financial transaction, giving you a complete view of your finances.

3. Long-Term Investments (Fixed Assets): Tracks things like property and equipment, showing their value and how they depreciate over time.

However, SAP FICO services go beyond just managing individual tasks. They excel at:

- Integration: SAP FICO works seamlessly with other SAP programs, like Sales & Distribution (SD) and Material Management (MM). When you make a sale in SD, it automatically shows up in your FICO financials. Purchases made in MM are also recorded in FICO, giving you a full picture of your spending.

- Reporting and Analysis: SAP FICO services provide powerful tools to create reports and analyze your financial data. You can easily spot trends, identify areas for improvement, and make data-driven decisions to optimize your finances.

By streamlining processes, improving data visibility, and providing powerful analytics among others, investing in SAP FICO services can give a significant financial advantage to any business organization around the world.

What are SAP FICO Consulting Services?

SAP FICO consulting services are offered by experienced industry professionals who help businesses implement, optimize, and manage the SAP FICO module within the SAP ERP system. These consultants possess deep knowledge of financial accounting (FI) and controlling (CO) functionalities and can guide organizations through the entire SAP FICO lifecycle.

A typical SAP FICO implementation project involves phases such as gap analysis, configuration, data migration, user training, and go-live.

During the gap analysis phase, consultants analyze the client’s existing processes and identify gaps between their requirements and SAP FICO’s standard functionality. In the configuration phase, they configure the system to meet the client’s specific needs. Data migration involves transferring relevant data from the old system to SAP FICO, while user training ensures that employees are equipped to use the new system effectively. Finally, consultants oversee the go-live process and provide post-implementation support.

Benefits of Using SAP FICO Services

Financial management requirements become increasingly complex as companies grow. That is where SAP FICO Consultants can make a significant difference to your organization. These are the core benefits of engaging SAP FICO Consultants for your firm.

Improved Financial Reporting and Controlling

SAP FICO ensures that businesses have access to accurate, up-to-date financial data, allowing them to make decisions based on real-time information and insights about their finances such as trends in performance, among others. For example, it assists in setting up comprehensive reports that help an organization get intelligence on different parts of its finance operations.

For instance, this client used the SAP FICO system to streamline their financial reporting process. They were able to identify unnecessary costs in their operations through detailed reports and analysis. In turn, they introduced initiatives aimed at reducing overheads by 15% which led to substantial savings and improved financial health.

Increased Efficiency

SAP FICO automates manual tasks such as data entry, invoice processing, and account reconciliation thereby freeing up employees for higher-level analytical work. The following specific areas provide examples of efficiency gains:

- Automated invoicing: This reduces errors while saving time spent on manual data entry.

- Faster month-end closing: Process streamlining reduces the time required for the closure of books.

- Real-time financial tracking: Quick access to financial data eliminates the need for reconciliations that depend on paper records alone.

- Integrated financial operations: No double entries due to integration with other SAP modules enhancing overall productivity.

Financial operations can be optimized and laborious processes eliminated if businesses implement SAP FICO with assistance from an SAP FICO consultant which will lead to these efficiencies. Finance teams realize significant productivity gains from time saved using automation and integration functions within the SAP FI CO software application suite.

Better Use of Financial Information

This includes budgeting features forecasting tools and financial analysis tools that are offered by SAP FICO aimed at improving the use of financial information. These resources help in financial planning and resource allocation for businesses in many ways.

By utilizing SAP FICO budgeting functionality, businesses can develop and manage budgets across different cost centers or projects. Through forecasting tools, companies will predict future revenues, expenditures, and cash flows concerning historical data and market trends as well. Moreover, SAP FICO has come up with robust financial analysis features that enable organizations to examine profit margins, find saving opportunities as well as make decisions that are based on data.

Those attributes coupled with advice from an SAP FICO consultant allow companies to understand their performance, allocate resources effectively, and have knowledge before investing in issues such as cost control amongst others.

Increased ROI

Through the reduction of costs and improved financial management SAP FICO can offer a substantial return on investment (ROI) for businesses. Automation capabilities reduce errors resulting from manual processes while operational efficiency improves leading to cost savings. Additionally, better financial controls and insights provided by FICO may identify new revenue opportunities.

For example, a large retail chain implemented SAP FICO through an SAP FICO consultant. In the first year alone they reported a 20% decrease in accounting errors as well as 15% fewer days required for closing finances. As well they increased sales by 8% after optimizing inventories using reporting options available in SAP FICO thus yielding over 25% ROI within the first two years

SAP FICO is known for its powerful functionalities but a skilled SAP FICO consultant can help maximize the potential of this system. This enables consultants to customize the systems to fit specific needs and ensure smooth implementation that brings about a fast return on investment.

Improved compliance

SAP FICO enables businesses to comply with financial regulations and reporting standards. It provides for exact accounting records, audit trails, as well as reportage devices that adhere to guidelines outlined in Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

An SAP FICO Consultant can assist organizations in configuring the system based on industry-specific regulations i.e., Sarbanes-Oxley Act (SOX) for public firms, Basel III for banking & financial institutions, or Revenue Recognition Standards for software & service providers.

Transparency, robust controls, segregation of duties and audit logging features are some of the ways through which SAP FICO ensures that an organization remains compliant while principles are adhered to reducing the risk of non-compliance penalties and ensuring accurate Financial Reporting.

How Advayan Can Help With SAP FICO Services

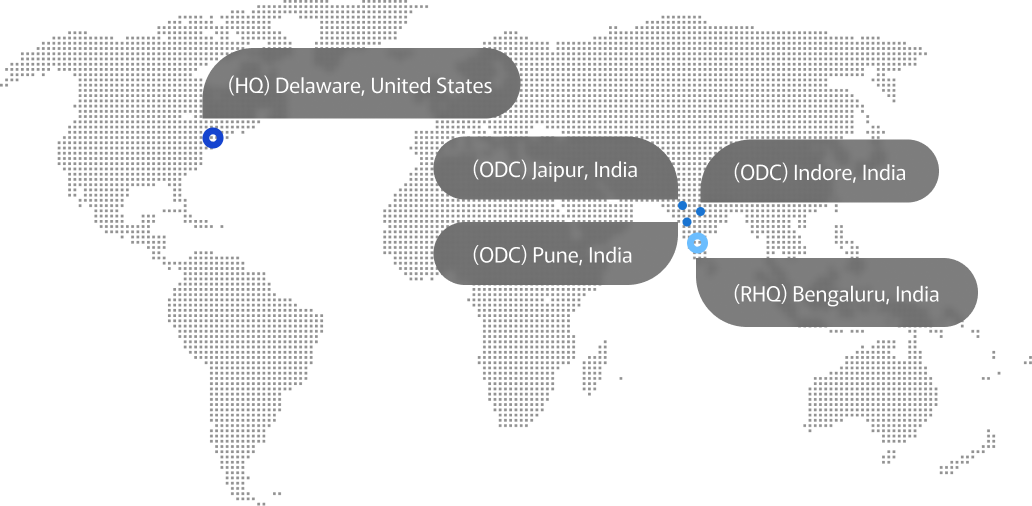

We have a deep understanding of implementing a well-executed SAP FICO system at Advayan. Our certified consultants work with clients from many industries to make sure they take full advantage of SAP FICO.

Our Team’s Expertise

To ensure successful implementations, our consultants hold recognized credentials in SAP FICO. This professional knowledge base is complemented by several years of experience which helps us tailor and customize solutions depending on your unique requirements.

Industry Knowledge Matters

In terms of industry-specific financial processes and regulations, our consultants know what you are talking about whether it is manufacturing, retail, or healthcare. We then configure SAP FICO to perfectly integrate into your current workflow systems.

Success Stories Speak Volumes

A number of companies have achieved breakthroughs through implementing SAP FICO. One example is when we worked together with one manufacturing client who had serious problems with manual activities as well as mistakes in their financial reporting process. By using SAP FICO, we automated tasks, simplified workflows, and improved data accuracy; this eventually led to a 30% decrease in processing time and a significant reduction in financial reporting errors.

The chief finance officer said, “Advayan’s consultants were very helpful.” “Their specialization in SAP /FICO/ was very useful for our enterprise. The new system has allowed us to better manage finances and relieve employees from routine work.”

Partner with Advayan for Your SAP FICO Journey

Advayan will be your companion throughout your journey with SAP FICO. Starting from the initial phase of analysis and gap assessment up to user training, configuration, data migration, and support services we offer an extensive range of services. Call us now so that we can listen to your needs today and show you how you can unlock the true potential behind SAP’s FI/CO solution.

Conclusion

To better reporting, improved efficiency, resource optimization, cost savings, and compliance with regulatory requirements among many other things SAP FICO services implementation could significantly improve financial operations. These benefits can be unlocked by companies who hire a SAP FICO Consultant to simplify processes and grow over the years on SAP Finance and Controlling (FICO).